Incorpo Agent

Your company’s all-in-one compliance solution

Put ongoing compliance, filings, and reports on autopilot. Never miss a deadline. Now includes beneficial ownership filings.

What’s a registered agent?

Registered agents act as a company’s official point of contact. Their job is to receive tax forms, legal notices, and other key documents from the state. All 50 states require businesses to appoint a registered agent.

More than a registered agent

We offer much more than just a name on a piece of paper you’re used to seeing. That’s because our team understands the complex legal requirements in each state to let you operate and scale your business as freely as you want.

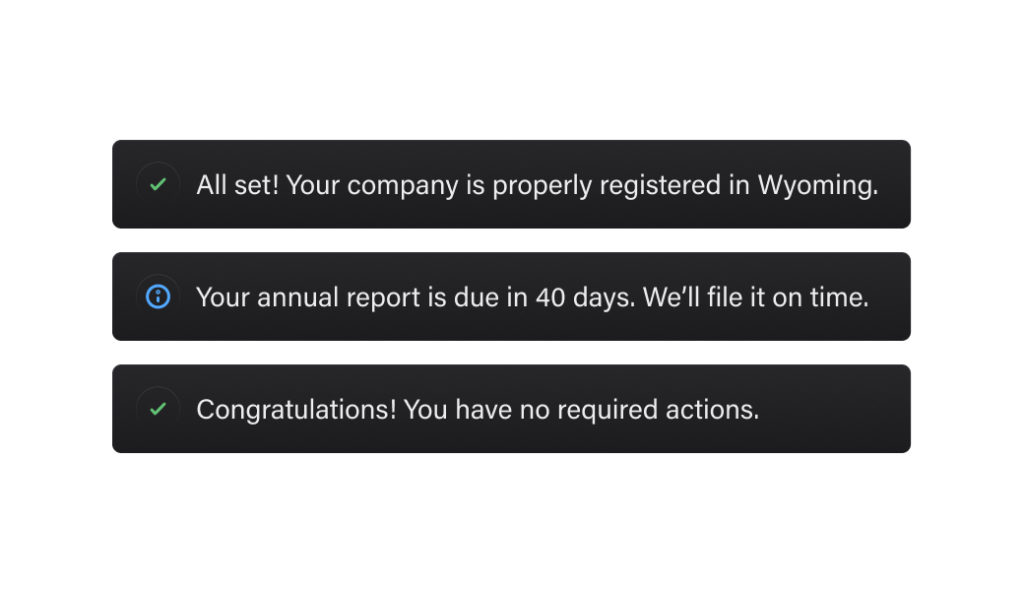

Automated peace of mind.

We track all compliance requirements and deadlines to keep your company in good standing. With our Autopilot and Payroll plans, we’ll file all annual reports, franchise taxes, and beneficial ownership information reports on your behalf!

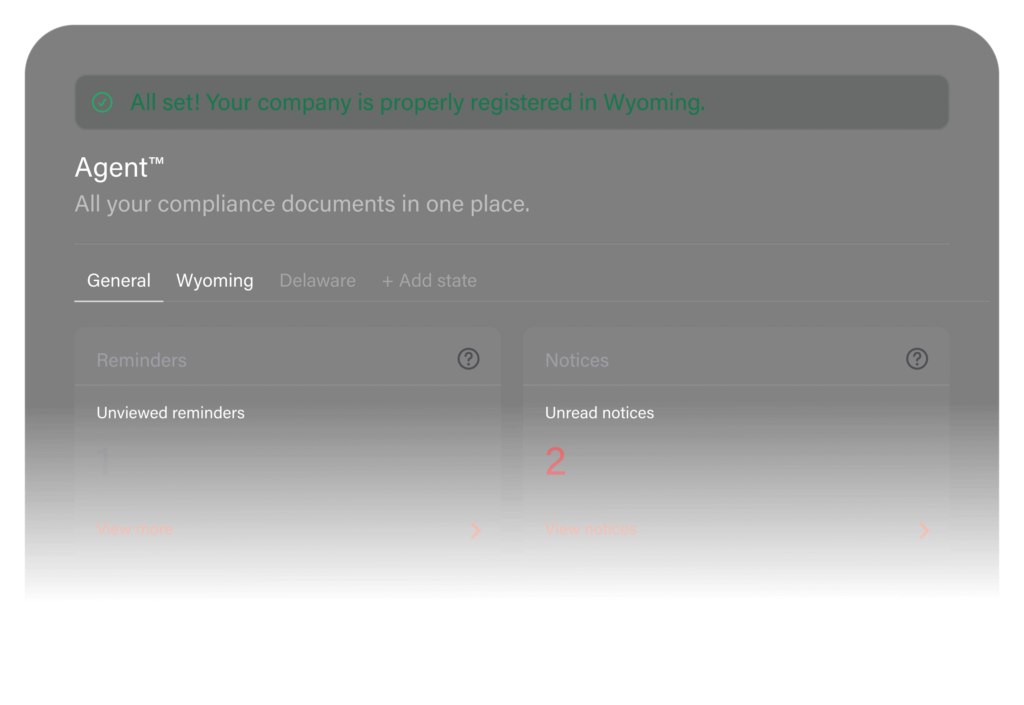

Your command center awaits.

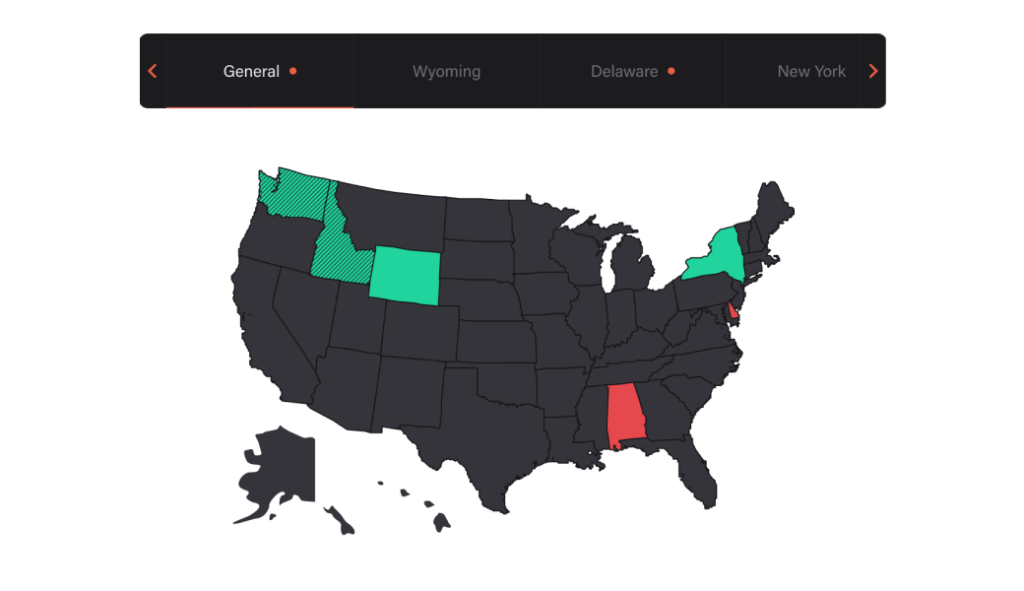

Get an instant overview of your company’s status in each state. Click on a state to view requirements, upcoming deadlines, and take any necessary actions. Forget all the government websites— manage everything from your compliance dashboard.

Registered agents where you need them.

All US companies are required to have a registered agent in each state where they operate. Don’t worry — we’ve got you covered with registered agents in all 50 states.

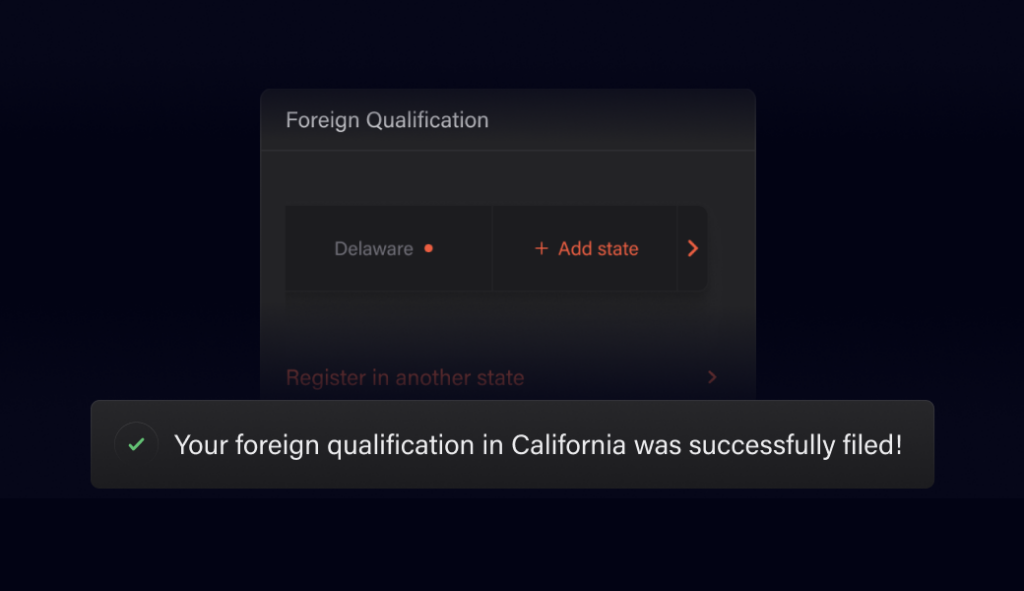

Foreign qualification when you need it.

Need to expand your business to a new state? No problem. Just select a state on your compliance dashboard and we’ll take care of it for you.

Compliance in just one click

Get integrated one-click services to manage more complex compliance across multiple states effortlessly, so your business always stays one step ahead.

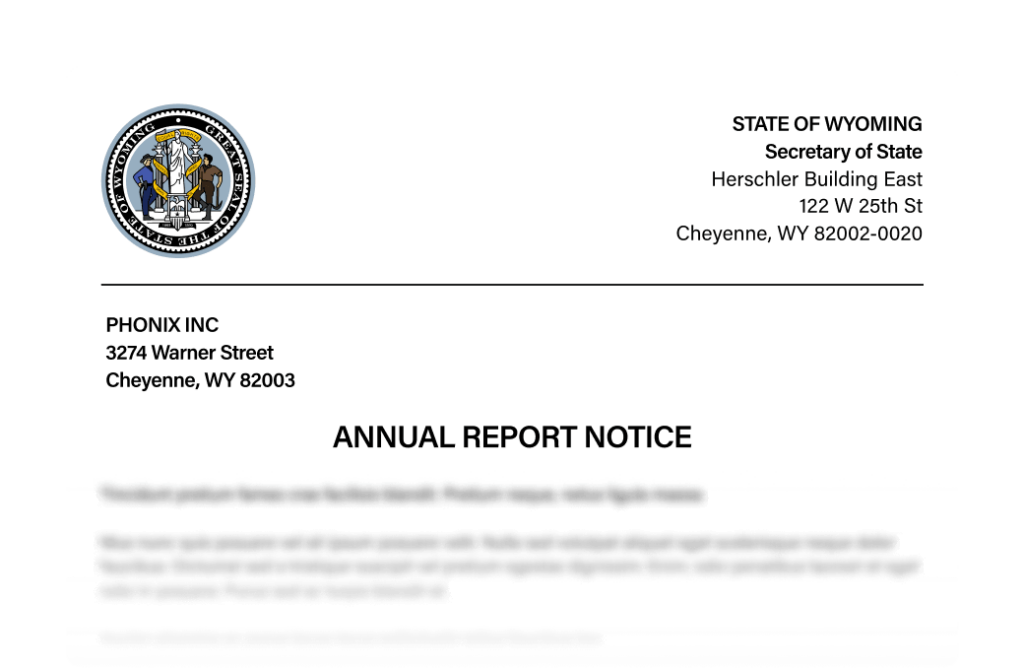

File reports and taxes fast, with confidence.

We’ll file your state annual reports and franchise taxes in every state where your business operates.

Expand your business in more states.

We’ll register your company to transact in other states so you can build your business across state borders.

Set up compliant payroll in any state.

Register for Payroll™ to compliantly hire remote employees, process payroll, and file tax returns. Available in all 50 states.

Pricing for additional services varies by state.

Level up your compliance

Whether you’re just getting started, or you need payroll tax registration, we’ve got you covered. Choose the plan that’s right for you.

Light

$149

per state/year

- Registered agent services

- Foreign qualification

- State compliance reminders

- Visual compliance dashboard

- State annual reports

- Beneficial ownership information filings *

- State franchise tax filing

- Payroll tax registration

Autopilot

$299

per state/year

- Registered agent services

- Foreign qualification

- State compliance reminders

- Visual compliance dashboard

- State annual reports

- Beneficial ownership information filings *

- State franchise tax filing

- Payroll tax registration

Payroll

$599

per state/year

- Registered agent services

- Foreign qualification

- State compliance reminders

- Visual compliance dashboard

- State annual reports

- Beneficial ownership information filings *

- State franchise tax filing

- Payroll tax registration

State fees (e.g. to foreign qualify) or taxes owed are paid separately.

Plans do not cover overdue filings or work needed to attain good standing at time of purchase.

* To access beneficial ownership information filings feature, you must purchase Autopilot or Payroll in your company’s incorporation (domicile) state.

How to get started

1

Submit your business information.

Fill out some details about your company. We’ll legally change your registered agent in your incorporation state.

2

We’ll handle the paperwork.

Whether it’s annual reports, filings, or transacting in other states, we’ll manage your registrations through our online dashboard.

3

We’ll keep you compliant.

We’ll manage your ongoing compliance and keep you up-to-date on approaching deadlines and changes to compliance requirements as your company grows.

Frequently Asked Questions

Registered agents act as a company’s official point of contact. Their job is to receive tax forms, legal notices, and other key documents from the state. All 50 states require businesses to appoint a registered agent. Learn more

LLCs, corporations, and other business entities must appoint a Registered Agent, which serves as an official point of contact for your business. Without a Registered Agent, you could be prohibited from doing business and possibly subject to financial penalties.

Despite the word ‘Agent’, the job of a registered agent is not to provide tailored business guidance. Their sole responsibility is to receive tax forms, legal notices, and other key documents from the state and forward them to the business’s responsible party.

No, you need a registered agent in order to incorporate your business. Missing filing deadlines or failing to update registered agent information could lead to fines, increased liability, or even the loss of your business license.

Businesses that are incorporated in one state must file a foreign qualification in order to operate in another state. The only alternative to foreign qualification is to incorporate a separate business in each state.

States generally require foreign qualification when an out-of-state entity conducts business in their jurisdiction. The legal definition of conducting business varies by state and often covers a broad spectrum of activities. Common reasons why businesses foreign qualify include:

- Hiring an employee who is a resident of a state other than the state of incorporation.

- Purchasing property or a building.

- Opening a new office or other facility.

- Offering services, selling products, or bidding for a contract.

- Applying for a professional license, as licensing agencies generally require foreign qualification.

An Annual Report is a filing that details a company’s activities during the past year and to provide public disclosure regarding names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address. Nearly all state requires an annual report from every corporation and LLC that operates under its jurisdiction. Your company is required to file in the state where you first formed as well as in every other state where you’re registered to do business.

The US Financial Crimes Enforcement Network (FinCEN) has issued a final rule requiring entities to report information about their beneficial owners and individuals who have filed an application with governmental authorities to create the entity or register it to do business. These requirements are intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity. The rule went into effect January 1, 2024, and all businesses must submit a beneficial ownership information filing. Learn more

Get started with Incorpo

Start, grow, and manage your business. We’re with you each step of the way.